Ideal Business Program

Foundations

The Ideal Business Program

The Ideal Business Program is the fastest way to grow your business using best-practise systems with easy to use templates and processes...

The 4 Foundations below will deliver the income, freedom and scale that you're looking for from your business...

It’s like an MBA for business owners using your business as the case study. All content has been field tested over a decade and represents the best method of getting fast, tangible and bankable results for business owners. No matter how large or small the business, the owner will benefit and learn from the curriculum.

The Curriculum

FOUNDATION #1:

Sharpen Your Margins

[How to Make Profit]

Fortnightly sessions with exercises that include templates that fit immediately into your current financial systems

The Process:

- Optimising your pricing and costing systems to improve your gross profit margin

- Maximising your cashflow using the 7 methods that bring in the fastest cash

- Understanding how to run your business for performance with basic financial data

The Outcome:

Your business will increase the amount of money you make on every transaction.

The 5 Sessions:

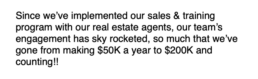

FOUNDATION #2:

Scale Your Talent

[How to Manage People]

Everything you need to turn ‘ok’ or ‘flat’ performers into self-motivated and collaborative team members with templates that fit immediately into current management practises

The Process:

- Building team motivation using a 4-step engagement process that boosts productivity

- Establishing performance management with scoreboards for monitoring your team

- Templating with the 9 attraction tools that produce an ideal work environment & culture

The Outcome:

Your business will have systems to recruit, retain and get high performance from your people.

The 5 Sessions:

FOUNDATION #3:

Master Your Marketing

[How to Generate Leads]

Fortnightly sessions with exercises that include templates to develop campaigns that fit immediately into your current marketing activities

The Process:

- Utilising your networks so your clients and contacts generate referral leads for you

- Positioning your uniqueness and developing marketing collateral for campaigns

- Generating high quality leads from your online marketing and social platforms

The Outcome:

Your business will have a reliable marketing strategy that produces high quality leads that add to your current client base.

The 5 Sessions:

FOUNDATION #4:

Upsize Your Sales

[How to Increase Sales]

Fortnightly sessions that include templates to give you a sales process that produces higher conversion rates and transaction values with more repeat purchases

The Process:

- Building a sales pipeline with techniques that remove the focus on price

- Developing your influence skills to convert clients into higher value transactions

- Handling objections and overcoming resistance with simple to use scripts

The Outcome:

Your business will increase its sales revenue from having a reliable method to covert more enquiries at higher transaction values with new and existing customers/clients.

The 5 Sessions:

PLANNING SESSIONS

Quarterly Planning Sessions

Each of the Four Foundations (in the above curriculum) is launched with a Quarterly Planning Session.

There are four sessions (quarterly ☺) per annum each with a different theme. All planning sessions feature the signature 1-Page Plan that lists out 3 core projects for the upcoming quarter and a scoreboard for monitoring results over the period being planned for.

Quarter 1:

The Launch Plan

Clients reflect on the year and put together a plan to make the new year their best yet. They will set goals for their business for income, freedom (time away from their business) and the scale they want to achieve. In this planning session there’s a particular focus on the business owner and their personal performance to ensure they have a plan for the role they have in leading others. This process leads into the completion of the 1-Page Plan.

Quarter 2:

The Scale Plan

Clients reflect on the previous quarter acknowledging wins and challenges. In this planning session the focus is on trouble-shooting key bottlenecks that can slow the growth of business development. This process enables all parts of the business to be evaluated for their performance. Goals are then completed around these projects before completion of the 1-Page Plan.

Quarter 3:

The Anti Plan

This session extends the focus on strategy to address the required shifts in attitude that produces new levels of success. Exercises allow the business owner to consider the environment they create for their team, the time they are committing to projects that have longer-term payoffs and the hurdles that slow down implementation of their plan. Goals are then completed around these projects before completion of the 1-Page Plan.

Quarter 4:

The Escape Plan

This session addresses the end-of-year period when many business owners will be looking to take a break away (hence “The Escape Plan”). Exercises and templates in this session put in place the people and system requirements in their business to allow the business owner to be absent from their business. The focus is on being able to take a break without the usual “checking in” calls that disrupt so many holidays. Goals are then completed around these projects before completion of the 1-Page Plan.

Get in touch for more details...

Values Profile

Your Free Profile

Values Profile

Gives you a measure of the 7 Values that drive your behaviour.

- The top 2-3 Values of your profile are assessed as your “Core Values”.

- If your Core Values are not being met you’ll feel unmotivated and less than confident.

- When your Values “clash” against each other or with other people in your life you’ll also feel “flat”.

- Knowing your Core Values gives you tools to stay self-motivated and more self-confident…

Where should we send your Profile Link to?

Guide Book

**BONUS GIVEAWAY: DOWNLOAD NOW AND RECEIVE FREE GUEST PASS TO NEXT LIVE QUARTERLY PLANNING EVENT**

2024 Guide Book

5 Simple Strategies

This is THE Must-have Resource For Business Owners Who Want Fast, Bankable Results Within 5 Weeks, Even If You're Time Poor & Under The Pump...

Where should we send your copy?

5 STEPS... 5 WEEKLY CHALLENGES

Every business is battling issues around rising costs, tighter margins, staff recruitment, marketing results, team performance, or a combination of all of them!

That’s why we’ve condensed the best strategies that have given our clients the biggest gains, into an easy to read Guidebook, to give your business a solid boost over the next 5 weeks...

The 5 Steps

The Time Challenge:

you’ll do a super-simple exercise that will shock you with how easily you can get your time back…

The Money Challenge:

how to give yourself a profit boost by learning how to spot “profit-leakage” in your business…

The Cashflow Challenge:

these are 3 easy tactics to speed up the cycle of doing the work and getting more cash in your bank…

The Customer Challenge:

working out where you make your easiest money (and from who!) will change the way you do business…

The Leadership Challenge:

this one will stretch you to think about how to best play to your strong suits… (spoiler: you’ll see a profiling tool that’s packed with powerful insights!)

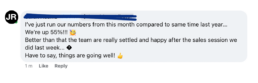

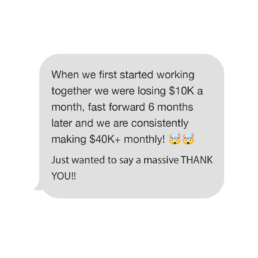

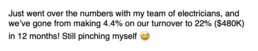

The Results

These 5 strategies give you the best cash-flow, lead-flow and work-flow results in the fastest time possible…

- Many business owners blame themselves for not knowing how to make their businesses easier to run and more profitable… it’s NOT a lack of skills.

The Guidebook will show you what you should be focusing on…

- Too many business owners hit a ceiling and never make the kind of money (or build the level of business value) to give them what they deserve...

Simple optimisation strategies in the Guidebook show you how to get there...

- So many people talk about the economy, the time of the year, the election cycle etc as reasons why their business isn't ideal...

Each strategy in the Guidebook is actionable by you and delivers a result regardless of external conditions...

Your Business Advisor [Author]

Meet Coach

Over the last 8 years, <name> has trained and mentored a select group of business owners, taking them from Stability, to Success and then Scale. <Name> shares the very best of what is for them so you too can develop your business into one that delivers the income and freedom that you’re looking for.

An IDEAL BUSINESS is possible for every business owner regardless of their current size.

Your Invitation

Quarterly Planning Session

Every quarter I get together with a small group of local business owners, going deep into the 3 critical drivers that make running your practice easier and more profitable.

During the session I’ll be sharing the complete system that I go through with clients to address the above. Instead of it taking months to deal with, you’ll build a complete plan in 1 hour.

Manufacturers

Manufacturers

Examples:

Engineering Shops, Fabricators, Assemblers, Component Manufacturers, Kitchen Manufacturers etc

INDUSTRY DESCRIPTION

Manufacturing is the process of converting raw materials and/or parts into finished goods that can be sold direct to consumer or business-to-business or to distributors or exported. It covers a wide range of industries from consumables to durables.

Buy raw materials and add value to it with labour and machinery to produce finished goods, then distribute it either yourself with a sales team or by using distribution partners. Manage the funding of purchases relative to the wages to produce finished goods and manage finished goods relative to sales made.

The life cycle of a manufacturing business often starts with a supply contract or a key account or customer who agrees to purchase products from the manufacturer. Often this decision to support a new manufacturer will be due to a quality or servicing issue with a current supplier. With a contract secured, plant, equipment and stock are established to begin manufacturing. Typically they are expensive to set up with heavy investment into not only plant and equipment but also initial orders of raw materials along with requiring personnel to operate machinery and move inventory. Obviously many manufacturing businesses are purchased as going concerns where key opportunities exist for example upgrading machinery with new investment, product development or adding sales expertise for market development.

The establishment phase of a manufacturing business requires the plant to be able to produce sufficient volume or quality of a finished product for a consistent cost price with a stable customer base that buy enough at the right price. If any of these processes are compromised the effect on cashflow can be extremely damaging. The expansion of a manufacturing business often means adding a sales team and or technical sales personnel or specialist design services etc. This changes the focus of the business towards managing sales teams, key accounts and customer consultation processes. All this requires the manufacturing operation to be able to maintain its quality controls. For this reason owners need to become adept in managing departments otherwise they tend to get dragged back into the plant.

Typically manufacturing businesses come under pressure when high overheads are present without the volume of sales required to cover them. This is especially true when debt serving is high. They also become stretched when additional outgoings are added without sufficient management e.g. sales personnel are being recruited but not trained or when market development and product development opportunities are being missed etc.

When to get help

Owners of manufacturing businesses will tend to need help from a Business Advisor for any combination of the above circumstances. A key indication of needing help is when they are struggling to manage cashflow or when they need an expansion strategy to take advantage of market development opportunities. Typically we assist manufacturing businesses with an initial assessment of the current cashflow position together with their sales and marketing systems. Then we’re able to assist on how to optimise their current operation model before engaging in strategies to drive profitability.

Lets Connect

Let's Connect...

Book a 20 minute Business Strategy session and let's find out your next right step...

Whether it’s promoting your Business or helping with a pressing issue, a 15 minute Brainstorm is a great place to start. If I can help you I will and if I can’t I’ll see if I can point you in the right direction.

When you book into this call, I’ll also send you an email to get a few details prior to our Session so that we can make the most of our time together...

Meet Coach Name

Your Local Advisor

Meet Chris

One Liner. 3 short facts.

As your local business advisor I have two separate but connected roles: one is to connect with the local business community with workshops and educational material, the other working with clients.

As your local business advisor I have two separate but connected roles:

One is to connect with the local business community with workshops and educational material, the other working with our clients.

Business Advisor

Working with clients on a Return-On-Investment (ROI) basis.

This means the income made by clients as a result of working with us must be at least a 5 times ROI. We believe fee structures should be transparent and accountable. For this reason we have proprietary software to ensure both client and advisor have an ROI “fit” before starting a program.

The objective of a client partnership is to meet agreed performance standards to:

Maximise client income…

Rationalise client effort…

Optimise client scale…

Promoting Locals

Every one of our consultants lives in a local community and drives past hundreds of businesses every day.

Every one of our consultants lives in a local community and drives past hundreds of businesses every day.

Since TAN was established in 2014 we have met, promoted and helped thousands of local businesses with this program. Help has taken many forms from Free PR where businesses are promoted on our social media platforms through to assessing businesses for profit potential. Often business owners will simply want a few pointers from an outside perspective.

All our consultants do this on a voluntary basis as their contribution to building business success.

Planning Sessions

Quarterly Planning

- Every business owner needs to step away from the day-to-day running of their business to think about longer-term issues and opportunities.

- Often the best environment for this is with other business owners who are faced with the same challenge of balancing their operational role with their longer-term role of leading and managing their business towards its goals.

- Quarterly Planning Sessions make this easy where business owners are provided with a structured format to build their plan.

- All planning sessions feature our signature 1-Page Plan that lists out 3 core projects for the upcoming quarter and a scoreboard for monitoring results over the period being planned for.

- Business Owners are provided with a workbook and planning guide to ensure they walk out clear, focused and ready to achieve the projects they have set.

Free Guide Book

If you want to find the easiest way to generate success in your business using the best techniques to get there, then the Guidebook will show you how.

Trusted Advisor Network

Lana is a part of a dedicated team across Australia & New Zealand.

Our past 18 years in the advisory space has been the catalyst for developing our break-through approach.

Our programs are only offered to clients on an ROI basis after businesses have been analysed to determine the upside available to the business owner. Businesses must demonstrate a 500% ROI to be eligible for a program. This approach has been developed after years of in-field experience of being consultants, coaches, trainers and presenters.

Most importantly, over the last 12 years TAN has developed a deep understanding of working with business owners from every industry imaginable.

It has allowed us to continually develop leading methodologies, systems and intellectual property that makes up our program material. The synergy of working in partnership with our team along with such diverse clients has given us a collaborative culture that has become the most valuable part of the way we operate as a network.

Promote My Business

Your Free PR Piece

Business Feature

Part of My Role as Local Advisor is to Promote Businesses like Yours...

We do this through a Business Feature… It’s like a Free PR Piece for your Business on our Local Business Network page.

Our goal is to Promote every Business in our Local Area…

We do a short interview, write it up & post it on our Facebook Page (checking with you first so you know what’s been said).

Your turn? Leave us your details below & I'll be in touch shortly...

Courses + Programs

Programs

Premium Programs &

Short Term Courses for Business Owners...

Premium Programs

Ideal Business Program

The Foundations Program will teach you the fastest way to grow your business with best-practise systems.

It’s like an MBA for business owners using your business as the case study. All content has been field tested over a decade and represents the best method of getting fast, tangible and bankable results for business owners. No matter how large or small the business, the owner will benefit and learn from the curriculum.

1:1 Premium Program

Our premium programs are operated

one-on-one with our clients either in-person or on Zoom (depending on logistics and selection of premium program).

Bronze Program

- Includes all parts of the Foundation Program (curriculum above)

The program also provides once a month Strategy Session to provide advice, answer questions, problem solve, trouble shoot, check progress and develop opportunities

Bronze Program is perfect for businesses with 1-3 team members

Silver Program

- Many business owners will need an intensive program to address the many issues and opportunities that arise from running their business.

- The program provides a comprehensive strategy session twice a month to assist with progress and growth.

- Silver Programs give a high level of communication between client and advisor outside of the session times as required.

- The program also has full access to the Foundations Curriculum as described above.

- Silver Program is perfect for businesses with 3-30 team members.

Gold Program

- In Gold Program there is a specific focus on the team especially for those businesses who either have or are developing management teams.

- Presentations and Facilitation with the team as a group are key components of the Gold Program.

- This program can also provide a Professional Development program with the team (details below).

- Team programs allows the business owner to focus more heavily on building and managing culture as well as KPI’s.

- Together with the focus on teams, this program provides comprehensive planning and strategy sessions for advice and management of the strategic business plan.

- The program also has full access to the Foundations Curriculum as described above.

Professional Development Program

Today’s environment for recruiting and retaining team members is a very different one compared to years gone by.

All business owners have no choice but to deal with the skills shortage, the cost-of-living crisis and mental health issues. These are over and above the usual management challenges of ensuring a stable work-force with team members that perform the required duties of their role.

Being able to have a trusted advisor to operate a Professional Development program allows business owners to focus on performance while ensuring the team are being provided for as well. The program gives each member of the team tools and training to understand how to utilise their personal strengths and attributes, together with how to maintain high levels of motivation and performance.

Short Term Courses

Scale Your Talent

[5 X 90-MINUTE FORTNIGHTLY SESSIONS]

[5 X 90-MINUTE FORTNIGHTLY SESSIONS]

- Building your team with the best people using the 9 attraction tools

- Establishing job descriptions, procedures and scoreboards for monitoring your team

- Templating for ads, pre-screening, interviewing, inductions and performance reviews

Sharpen Your Margins

[5 X 90-MINUTE FORTNIGHTLY SESSIONS]

[5 X 90-MINUTE FORTNIGHTLY SESSIONS]

- Calculating the degree of ‘Margin Squeeze’ in your business with how to fix it immediately

- Assessing your pricing system and implementing key strategies to boost your profitability

- Analysing your cash flow and identifying the tactics to unblock the cash in your business

Master Your Marketing

[5 X 90-MINUTE FORTNIGHTLY SESSIONS]

[5 X 90-MINUTE FORTNIGHTLY SESSIONS]

- Utilising your networks (including your clients) for referrals, alliances and JVs

- Establishing an online presence even if you’re not a marketer

- Generating high quality clients from your online presence and social platforms

Upsize Your Sales

[5 X 90-MINUTE FORTNIGHTLY SESSIONS]

[5 X 90-MINUTE FORTNIGHTLY SESSIONS]

- Developing your influence skills to convert clients into high value services

- Building a sales pipeline with techniques that create professional authority for you

- Handling objections and overcoming price resistance with simple to use scripts

The Alignment Session

- Together we’ll build your personalised plan for the goals you have for your business.

- Reviewing your pricing and services suite with your staffing and systemising needs.

The Hourly Rate Challenge

- These are fortnightly 90-minute intensives that establish the fundamentals of your business in 6 specialised sessions.

- The 6 sessions include topics such as The Time Audit, The Price Play, The Leader Profile each designed to provide you with actionable tasks for rapid results.

- The results from these 6 sessions will easily pay for the 12-month program.

Get in touch for more details...

Workshop

Workshops

Premium Workshops for Business Owners...

- R E - F O C U S on what Your Business owes you...

- R E - E N E R G I Z E with other owners solving business challenges

- R E - C O M M I T to Building Your Ideal Business with Income, Freedom & Scale

Planning Session

Quarterly Planning

Boost Your Business over the next 90 days...

- Solutions for your burning issues

- Compare how others are solving it

- Complete a plan to get it fixed in 90 days

To build an ‘Ideal Business’ means getting to work on 9 Key Projects in your business where money is either made, or lost…

So! In this Strategy Session...

- We’ll unpack the 9 Key Projects… so you know what each of them are

- You’ll choose the top 3… that will give you the best improvements

- You’ll walk out with a Workbook… that includes the strategies to work on

For your team

Team Workshops

When we chat to business owners about their team, this is what we hear…

- The team's a bit up and down, sometimes they’re engaged, sometimes not so much…

- There’s definitely a few issues that would be great to sort out, but everyone’s always so busy…

- It would be really great to get everyone motivated, on the same page and working together…

Many say that they know they’ve got a good team, but would really benefit from getting together to work on the business as a team. Team Talk does this making your business smoother to run and a better place to work…

So why do we do these?

Because we know it’s easier to have an outsider do this for you and you never know what opportunities will come out of this discussion.

Here's how it works...

” They ran a 90 minute workshop that got my team engaged. Everyone got a workbook with exercises that had my staff thinking and talking about my business”

“The whole workshop was facilitated and all I had to do was show up with my team!”

Profit Analysis

Business Optimiser

To help business owners answer these questions, we've purpose-built a software app to get answers...

We call it The Business Optimizer. And here’s the reaction we’ve had from business owners so far…

“The number in ‘Productivity’ showed us $29,300 available over 12 months… in 8 months we’ve already found $58,600″

“It came up with 174k which sounded a bit high… We’ve introduced several strategies that have us on track for $274k in the first year”

Those are the clean ones…. others included “holy <#*?@%&*:> really?”

You get the picture…

4 Questions that make finding out a good idea...

- How much money should I actually be making out of my business right now?

- What income is possible from my business or is this as good as it gets?

- What size does it need to be in order to make the money I want?

- What else should I be doing in my business to improve it from where it is now?

Strategy Session

Four Futures

An IDEAL Business will provide you with ALL THREE of these...

- Solid Income: so you're well paid for what you do

- Time Freedom: so you're not tied to your business

- Enough Scale: so it looks like the right size of business you had in mind

To build an ‘Ideal Business’ means getting to work on 9 Key Projects in your business where money is either made, or lost…

So! In this Strategy Session...

- We’ll unpack the 9 Key Projects… so you know what each of them are

- You’ll choose the top 3… that will give you the best improvements

- You’ll walk out with a Workbook… that includes the strategies to work on

1st step is a quick phone call to see if we can help… Contact me to find a time that we can talk!

Professional Advice

Professional Advice

We have a dedicated team of Business Advisors across Australia and New Zealand.

Our advisors have two separate but connected roles: one is to connect with the local business community with workshops and educational material, the other working with our clients. More details below...

Business Advisor

Working with clients on a Return-On-Investment (ROI) basis.

This means the income made by clients as a result of working with us must be at least a 5 times ROI. We believe fee structures should be transparent and accountable. For this reason we have proprietary software to ensure both client and advisor have an ROI “fit” before starting a program.

The objective of a client partnership is to meet agreed performance standards to:

Maximise client income…

Rationalise client effort…

Optimise client scale…

Promoting Locals

Every one of our consultants lives in a local community and drives past hundreds of businesses every day.

We built the Trusted Advisor Network to recognise that not all businesses will invest in a program with us, but that doesn’t mean we can’t help.

Since TAN was established in 2014 we have met, promoted and helped thousands of local businesses with this program. Help has taken many forms from Free PR where businesses are promoted on our social media platforms through to assessing businesses for profit potential. Often business owners will simply want a few pointers from an outside perspective.

All our consultants do this on a voluntary basis as their contribution to building local business success.